Instone Real Estate Aktie

Instone Real Estate Aktie Importance of Real Estate Stocks in Investment Portfolios Company Overview History and Background of Instone Real Estate Segments, Operations. Market Position and Competitive Landscape Historical Stock Performance. Valuation Metrics and Peer Analysis Recap. Future Outlook & Considerations Recap, as well as References are covered herein.

Introduction

Company Overview (History & Background of Instone Real Estate).

It is an established residential development firm in Germany known for focusing on urban spaces and eco-friendly solutions for their developments. Since their formation, Instone has enjoyed rapid expansion through strategic acquisitions and developments.

Business Segments and Operations

Instone operates within its geographic region and specializes in properties catering to specific demographics within that target. Their business model involves various aspects like land acquisition, development and sales– among many others– as well as development sales– among many more activities that make Instone run effectively.

Market Position and Competitive Landscape.

Instone Real Estate stands up against several big players in the development industry, such as [competitors and [competitors]. Their key strengths include location strategy and design expertise as their unique selling propositions.

Financial Performance Evaluation System of Instone Real Estate Aktie

Recent years have witnessed Instone Real Estate experience steady revenue growth driven by factors like demand trends and project completions as well as other project completion related events. Furthermore, an in-depth examination of Instone’s income streams reveal[s a breakdown of] their sourcesof revenuesand sourcesof profit

Profitability Metrics

Analyzing profitability indicators such as profit margins and return on equity provides insight into Instone’s operational efficiency as well as financial health

Debt and Financial Stability of Instone Real Estate Aktie

Financial assessments that analyze debt levels and stability are vital in understanding a company’s capacity to weather economic downturns while simultaneously developing growth strategies.

Strategic Initiatives, Expansion Plans and Projects (SPEPs)

Instone Real Estate’s expansion strategy entails entering new markets, diversifying pipelines of projects, etc. Some examples of major developments may also be highlighted as part of this expansion effort.

Innovation and Technology Integration.

Our company leverages cutting-edge techniques like specific technologies in order to increase construction efficiency and ensure sustainable design practices.

Sustainability Initiatives

Stone Real Estate is dedicated to being environmentally-friendly by employing green design principles, building techniques, energy-efficient construction techniques and other initiatives which meet regulatory regulations or market needs and requirements.

Investment Potential of Instone Real Estate Aktie

SWOT Analysis

An in-depth SWOT Analysis provides information regarding Instone Real Estate’s strengths, weaknesses, potential opportunities and risks which provides insight into its investing potential.

Risks and Challenges

Investors must carefully consider risks such as market cyclicity or regulatory changes when assessing the risks involved with investing Instone Real Estate as an asset class.

Analyst Recommendations and Market Sentiment

Analyst and market sentiment regarding Instone Real Estate provide invaluable insight into its perception and future outlook.

Valuation and Stock Performance of Instone Real Estate Aktie

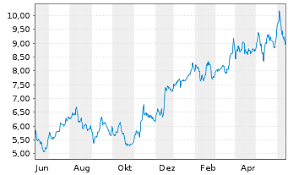

Historical Stock Performance has always been impressive.

Analyzing Instone’s historical stock performance will shed light on its fluctuations, growth rates and investor sentiment over time.

Valuation Metrics

Value metrics such as P/E Ratio or Price to Book Ratio provide investors with valuable data that enables them to determine whether Instone Real Estate Aktie has been over or under valued compared with their expectations, or priced reasonably.

Comparative Analysis of Peers

Comparing Instone’s financial performance against that of peers within its industry allows investors to assess its status and attractiveness for investments.

Conclusion Investment of Instone Real Estate Aktie

Thesis Recap Stone Real Estate Aktie provides an attractive investment opportunity due to [list the main reasons such as growth potential and market share etc].

Future Outlook and Considerations (FORC).

Future market trends, legislative amendments and investor returns could all play a key role in Instone Real Estate’s success as well as their returns.

References of Instone Real Estate Aktie

This report draws upon an array of sources – economic reports, analysis of industry and opinions of experts to gain an in-depth knowledge of Instone Real Estate Aktie as an investment option and its opportunity

Conclusion

As stated previously, investing in Instone Real Estate Aktie requires careful evaluation of its financial health, strategic initiatives and market positioning within the real estate sector. By taking an in-depth view of these elements as well as understanding broader economic conditions and trends, investors may make informed decisions to potentially capitalize on opportunities presented by this dynamic company.

3 comments